Big announcement regarding GST, With 40% GST, these items will now become more expensive, see the list of your work here

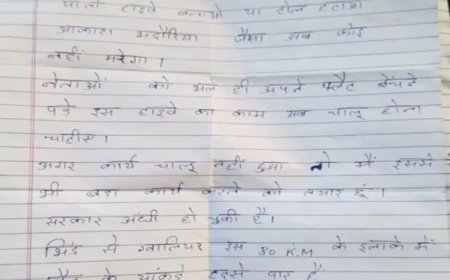

The 56th GST Council meeting announced major reforms effective from 22 September 2025. GST will now have only two slabs – 5% and 18%, replacing 12% and 28%. Most items will become cheaper, boosting the economy and benefiting the common man. Luxury and harmful items like pan masala, cigarettes, luxury cars, fast food, and sugary drinks will attract 40% GST as ‘sin goods’.

A big announcement has been made in the 56th meeting of the GST Council, which is a relief news for the common man. Now there will be only two slabs of GST - 5% and 18%, meaning the slabs of 12% and 28% will be removed. Most of the items will be merged in these two, due to which many things will become cheaper. Finance Minister Nirmala Sitharaman said that these changes will come into effect from 22 September 2025, which is the first day of Navratri. These reforms will benefit the consumer and the economy will get a boost.

40% tax on these things getting expensive

Now 40% GST will be levied on some harmful and luxury items, which will be called 'sin goods'. Its list includes pan masala, cigarettes, gutkha, chewing tobacco, zarda, carbonated drinks with added sugar, aircraft for personal use, luxury cars, fast food and super luxury goods. Apart from 40% tax, no cess or subtax will be levied. Tobacco products will remain at the old rates until the loan is repaid. These changes are targeting health and luxury, but the final date will be announced later.

The complete list is below -

- Super Luxury Goods

- Pan Masala

- Cigarettes Gutkha

- Chewing Tobacco

- Zarda

- Added Sugar, Carbonated Drinks

- Aircraft for Personal Use

- Luxury Cars

- Fast Food

Why is change in GST necessary?

The aim of the GST Council is to make the system simple, so that compliance is easy and disputes are reduced. There was revenue loss from the old slab, but now consumption will increase. States will get compensation, and the economy will get a boost. But some states like Punjab and West Bengal have expressed concern over revenue loss. Overall, these reforms are like a 'Diwali gift' for the common man.

With the removal of 12% and 28% slabs, most items will shift to 5% or 18%. For example, things like namkeen, sauce, instant noodles, chocolates, ghee, butter, coffee can come at 5%. TV, AC, dishwasher, small cars and motorcycles at 18%. There will also be relief on millet flour, molasses, EVs. These changes will benefit the middle class, and shopping will become easier during the festive season.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0