UP government gave big relief, No matter how many crores the property is worth... only this much stamp duty and registration fee will be charged

The Uttar Pradesh government has reduced stamp duty and registration fees for ancestral property division. Now, the maximum cost will be only ₹10,000 (₹5,000 stamp duty + ₹5,000 registration fee). Earlier, charges were based on 4% stamp duty and 1% registration fee, making property division costly. The new rule simplifies the process, reduces disputes, and applies only to family property division up to three generations.

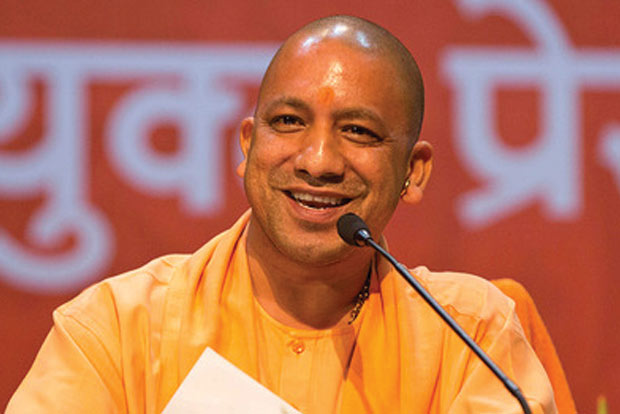

The Uttar Pradesh government has recently taken an important decision to simplify and cheapen the stamp duty and registration fees related to the division of family property. In the cabinet meeting held on 2 September 2025 under the chairmanship of Yogi Adityanath, it was decided that the maximum limit of stamp duty and registration fee for the division of ancestral property would be Rs 5,000, that is, the process of division can be completed in a total of Rs 10,000. This decision has been taken with the aim of making the division of family property easier and reducing the disputes related to it.

Under the new system, the total expenditure will be only Rs 10,000 (Rs 5,000 stamp duty + Rs 5,000 registration fee), which is much less than before.

What was the charge on property division earlier

Earlier system: Earlier, the stamp duty on property division was 4% of the property value (based on circle rate), which was applicable on all parts except the largest part. For example, if a property worth Rs 1 crore was divided into four parts, then 4% stamp duty (about Rs 3 lakh) and 1% registration fee (about Rs 75,000) had to be paid on Rs 75 lakh (three parts).

When will it be applicable

This exemption will be applicable from the date of notification by the Stamp and Registration Department. Stamp and Registration Minister Ravindra Jaiswal said that the notification will be issued soon, and this exemption will remain effective till further orders.

This exemption will be applicable only on the division of ancestral immovable property, which is between family members (up to a maximum of three generations). The division should be according to the current succession laws, in which all heirs get property according to their statutory share. This facility will be applicable only on properties owned by real persons, not on companies or other entities.

Essential conditions

To avail the exemption given under the new rule, Family Register has to be submitted, which contains details of three generations and valuation of each person's share. This exemption will be applicable only in cases where the division is among family members and it is in accordance with the succession laws.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0